Online grocery sales have gone through the roof in this current situation, as have other categories. New leaders in conventional retail are emerging, and the competition is increasing. Now is the time to monitor your competitors’ online sales.

Traditional retail giants such as Aldi, Costco, Kroger, Target, Walmart, Whole Foods and even others are heavily investing in online platforms to compete with the likes of Amazon.

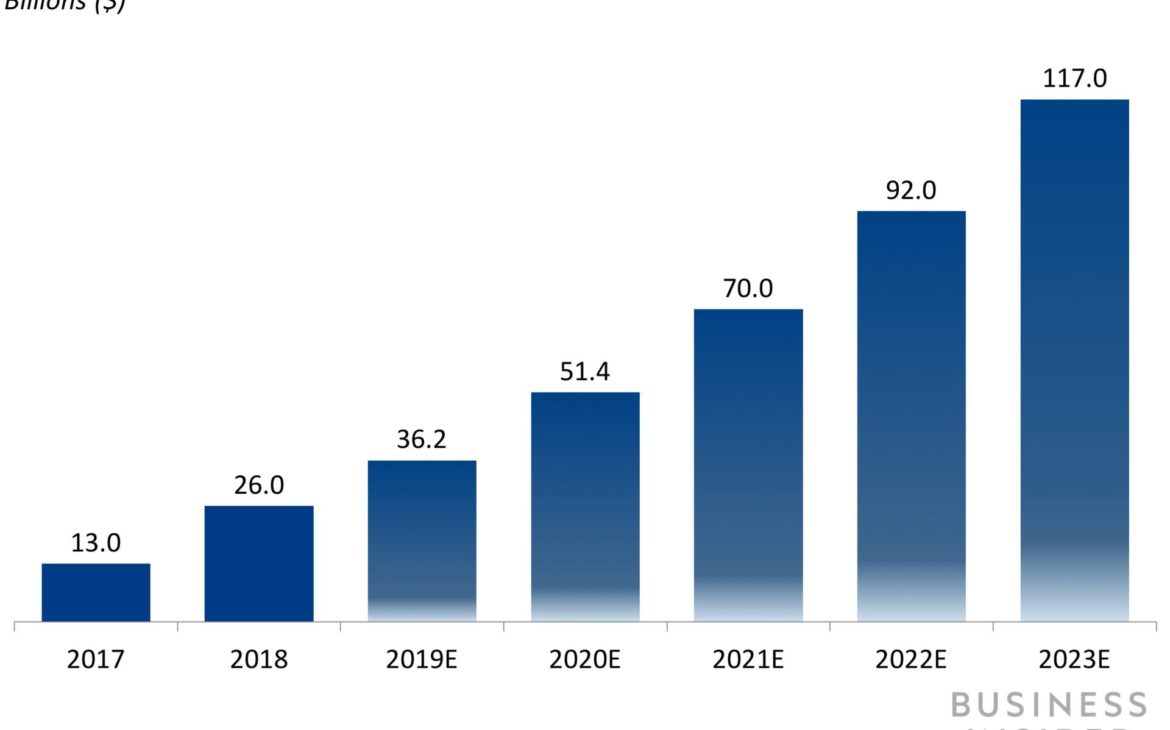

Business Insider estimates that the current online grocery segment will grow from an estimated $51.4 million in 2020, to a whopping $117 million by 2023. Therefore, this is the segment to watch, monitor and invest in.

The segment is driven by some key benchmarks like price comparisons, shipment costs, customer reviews, advertising spend and consumption mapping.

Gathering this data on your competition is critical. It helps you conduct a detailed competitive audit, map these benchmarks against your own and take actions to make yourself more competitive. Another key benefit of this data is the detailed insight it provides, which ensures that you effectively tailor to your online advertising, promotional campaigns and discounts to ensure company success.

There are many technologies and software’s available to gather, group and analyze this data for decision making in easily understandable formats such as Tableau, Power BI and Pythons. However, the critical key is to use this in implementing specific actions for improvements.

Here’s the dilemma: Many, if not most companies do not have specialist experts such as actuaries, high end statisticians, data scientists, and data programmers to model this flood of incoming data, harmonize it, present it in an understandable format to make it actionable.

So how do we handle Data Comprehension problems? In the past, companies looked externally to advertising agencies, then to digital media agencies who, along with research agencies, worked and conducted focus groups, surveys in the never ending search to determine consumer behaviours/preferences. This has dramatically changed in the online world as a huge amount of raw data is now available waiting to be transformed for decisions and actions. Your next big partner is no longer a digital media company, but data science companies who have this expertise and know how to transform this data and deliver it in the form of decision dashboards, helping brand and marketing managers make marketing decisions.

What are the hallmarks of a good Data Science Company ? While it’s not a simple checklist of attributes, some useful markers would be:

- The length of time the company has been in the business. The early leaders are usually much more robust, mature and highly experienced in data modelling.

- The type of clients they service. A company which is serving similar clients or industry segments will understand your needs much better, quicker and more insightfully.

- Is it a structured well-oiled team with discipline, robust internal processes and Data Scientists, Tableau & Power BI experts or just a bunch of folks who’ve come together? A structured entity is a better bet than a randomized group!

- Location is not key, virtual being a key element. But if you do happen to have a local presence it always helps.

- ROI. Most Data Science Companies work on a retainer. Some will do it on a one time project fee. In either approach, the key is to evaluate how this engagement by the extra sales or prevention of loss in sales or impactful marketing spent or better and cost effective utilization of the team.

- Length of engagement. This is an important factor as the results do not come immediately. A commitment to a mid to long-term engagement is essential to get the most out of data science companies.

Data Science companies or agencies are the new powerhouse and catalyst to optimize your sales and take your marketing spend to an effective level. Their skill set is now an essential part of your resources and tools. True for both online and brick and mortar channels.